- 83191 40435

- 206A, Yeshwant Niwas Rd, Silver Estate Meenal Shree, Shivaji Nagar, Indore, MP

End-to-end handling of tax audits under Section 44AB and timely filing of returns for Income Tax, GST, and TDS.

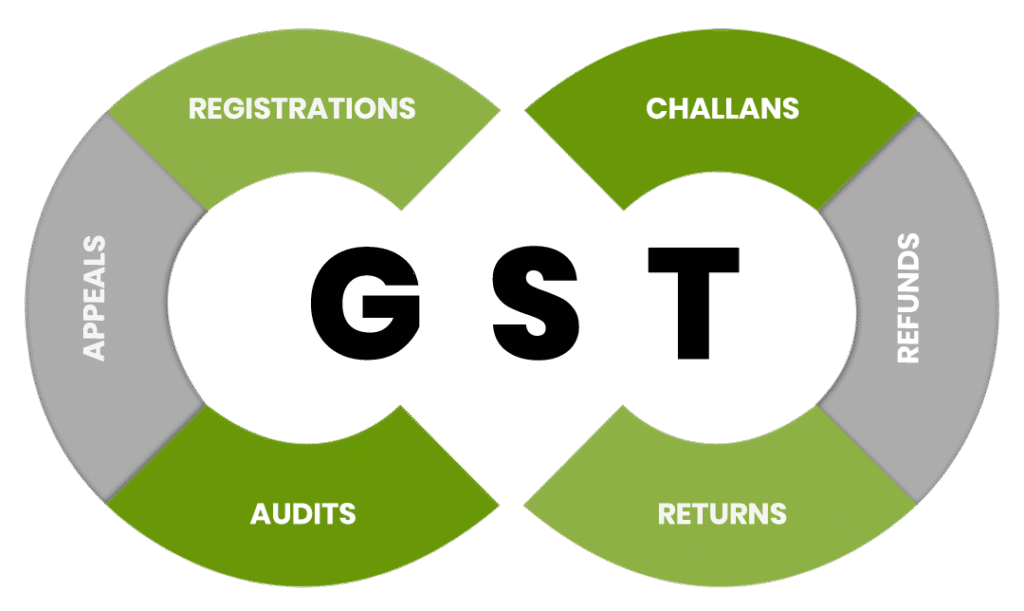

Advisory and operational support for all aspects of GST compliance including registration, return filing (GSTR-1, 3B, etc.), and dispute resolution.

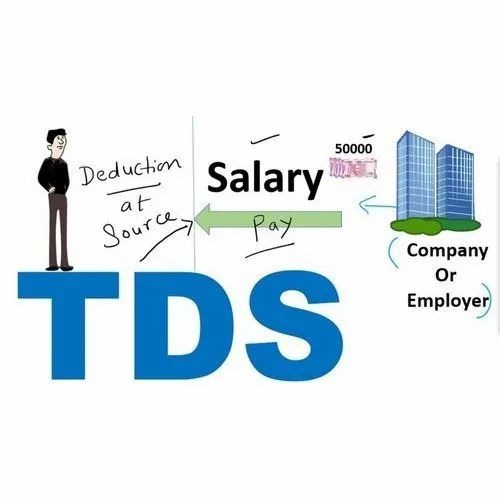

Assistance in timely deduction, deposit, and return filing of Tax Deducted at Source to ensure complete compliance with Income Tax rules.

Evaluation and implementation of internal controls in accordance with Section 134(5)(e) of the Companies Act, ensuring risk mitigation and fraud prevention.

Advisory on Indian Accounting Standards adoption, transition support, and ongoing compliance for corporates.

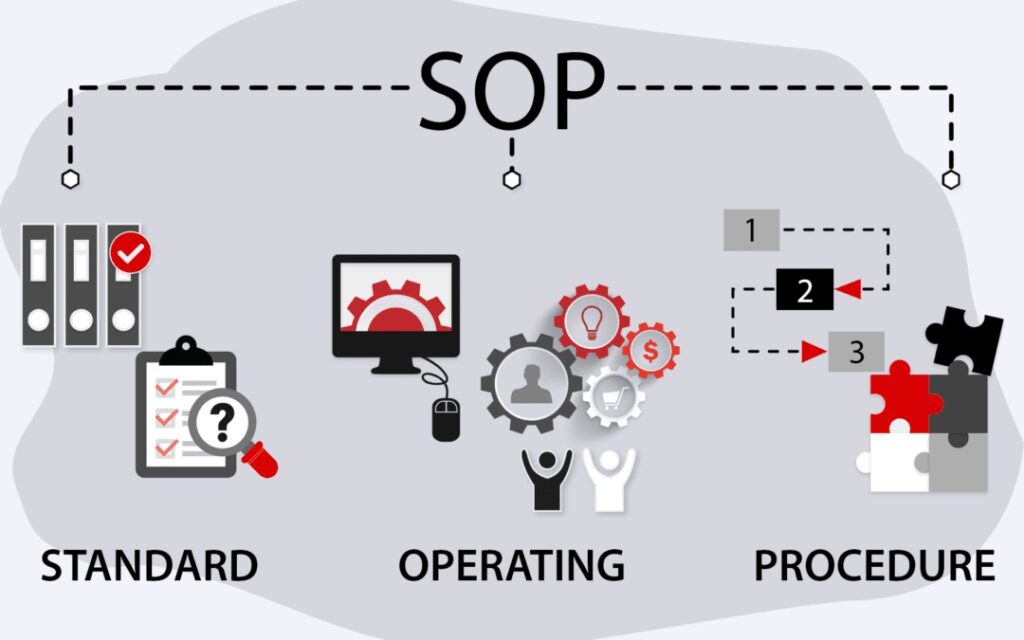

Establishment and audit of SOPs to streamline operations and enhance internal efficiencies.